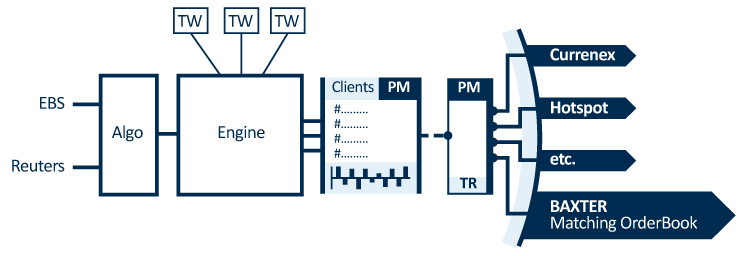

PriceEngine is a tool designed for foreign exchange (FX) trading, specifically for creating and managing customized streaming FX quotes for a bank's customers. PriceEngine has several key components:

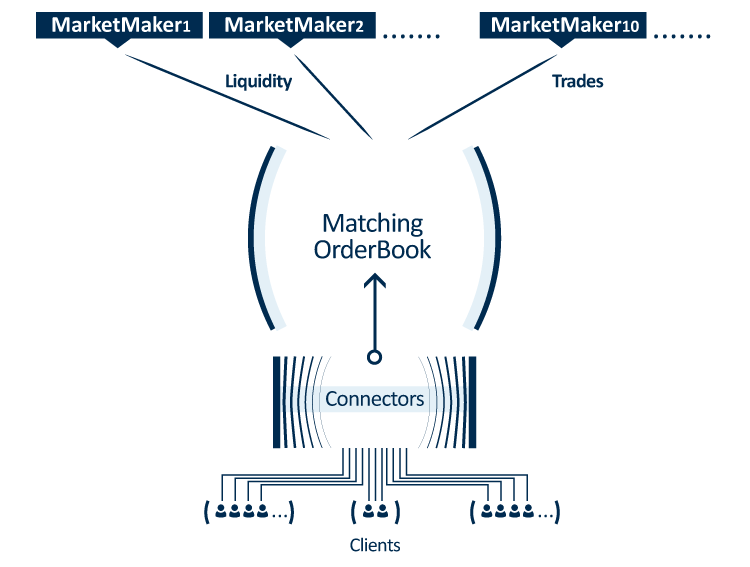

The Matching Order Book Engine is to match orders and convert them to trades when their target price level has been reached. It relieves Dealers from having to watch every order in the book and concentrate on their VALUE ADDED trading jobs.

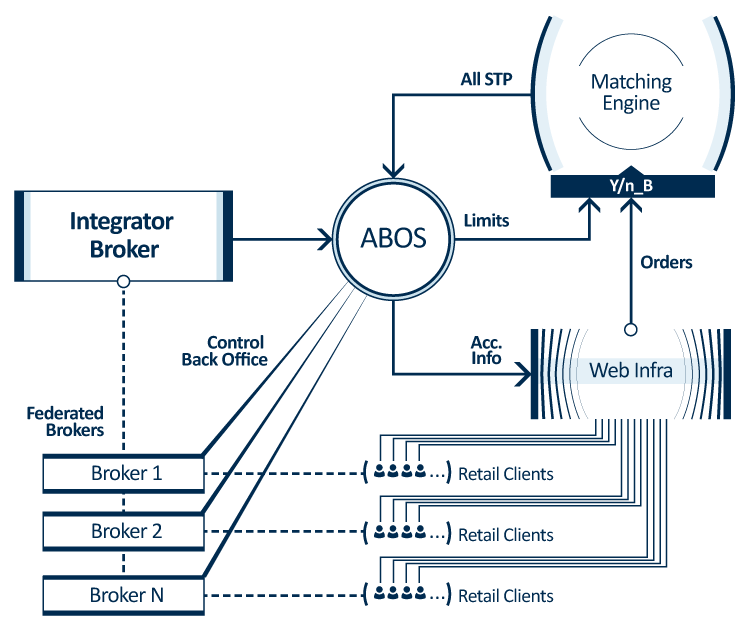

The Margin and Reval Back Office System is a comprehensive trading back office solution for institutional and retail clients, including Spot FX and other asset types. The solution is scalable to efficiently manage tens of thousands of accounts and millions of trades.

It includes connectivity to external vendors for cash deposits and withdrawals. Encompasses connectivity to a comprehensive set of external platforms for the receipt of STPs.

Incorporates easy integration with external platforms for information (client static data / real-time calculated information). It also comprises a comprehensive set of price source feeds for use in its internal calculations.

The technology solution is an assembly of three elements:

FX regulations significantly impact the foreign exchange (FX) market. Dodd-Frank FX, miFID, EMIR and the Tobin Tax all impact market participants in the world of FX trading. These rules have changed the way people conduct trades in the FX market and the reasons they decide to enter into trades. At BAXTER we take regulations seriously and have a solution that complies with all requirements.

Please use the tick boxes on the top of the screen to select the regulations suitsed to your environment.View regulation

Please use the tick boxes on the top of the screen to select the regulations suitsed to your environment.View regulation